2024 Business Planner for an Exponential Year of Growth

Are you ready to shape an unparalleled year for yourself?

Imagine enhancing your career, personal relationships, health, and overall life quality more smoothly than ever before. If you're wondering why this hasn't been your reality already, it might be simply because you have yet to be shown the way.

As we step into 2024, it's crucial to have a clear plan

A planner isn't just a tool; it's your roadmap to success. To start, sketch the big picture of your year. What does success look like for you? Is it expanding your customer base, launching new products, or scaling your operations? Your planner should reflect these broad objectives. This step sets the tone for a focused, strategic year.

Goal Setting: Revenue and Scaling Targets

Now, let's break down your big picture into tangible goals. Setting specific revenue and scaling targets is vital. Ask yourself: what are my financial goals for this year? How much do I aim to grow my business? These aren't just numbers; they're milestones that guide your journey.

By setting clear, measurable goals,

you're paving a path toward tangible success

Need a little inspiration for setting those goals?

The most common personal financial goals for Americans vary, reflecting the diverse challenges and aspirations people face in their financial journeys. Key goals identified for 2024 include:

Spending less money, building emergency savings, saving for retirement, paying off debt, buying a home, etc.

However…

For American businesses and entrepreneurs, several common financial goals stand out, each playing a crucial role in ensuring the stability and growth of a business.

Eliminating Unnecessary Expenses: It's vital for businesses to regularly audit their expenses, identifying and eliminating unnecessary costs. This could involve adopting technology solutions for efficiency, encouraging remote work to reduce office-related expenses, or outsourcing non-core tasks.

Investing in Business Growth: Entrepreneurs should actively seek opportunities for business expansion, whether through new product development, entering new markets, or acquisitions. A financial strategy for growth could include setting aside a portion of profits in a separate investment account.

Creating Multiple Revenue Streams: Diversifying revenue streams is crucial for reducing risk and ensuring business resilience. This can be achieved by exploring new products, services, or markets and developing passive income sources.

Understanding and Managing Cash Flow: Effective cash flow management is essential for maintaining sufficient operating capital. This includes careful tracking of revenue and expenditures and making informed decisions about business financing.

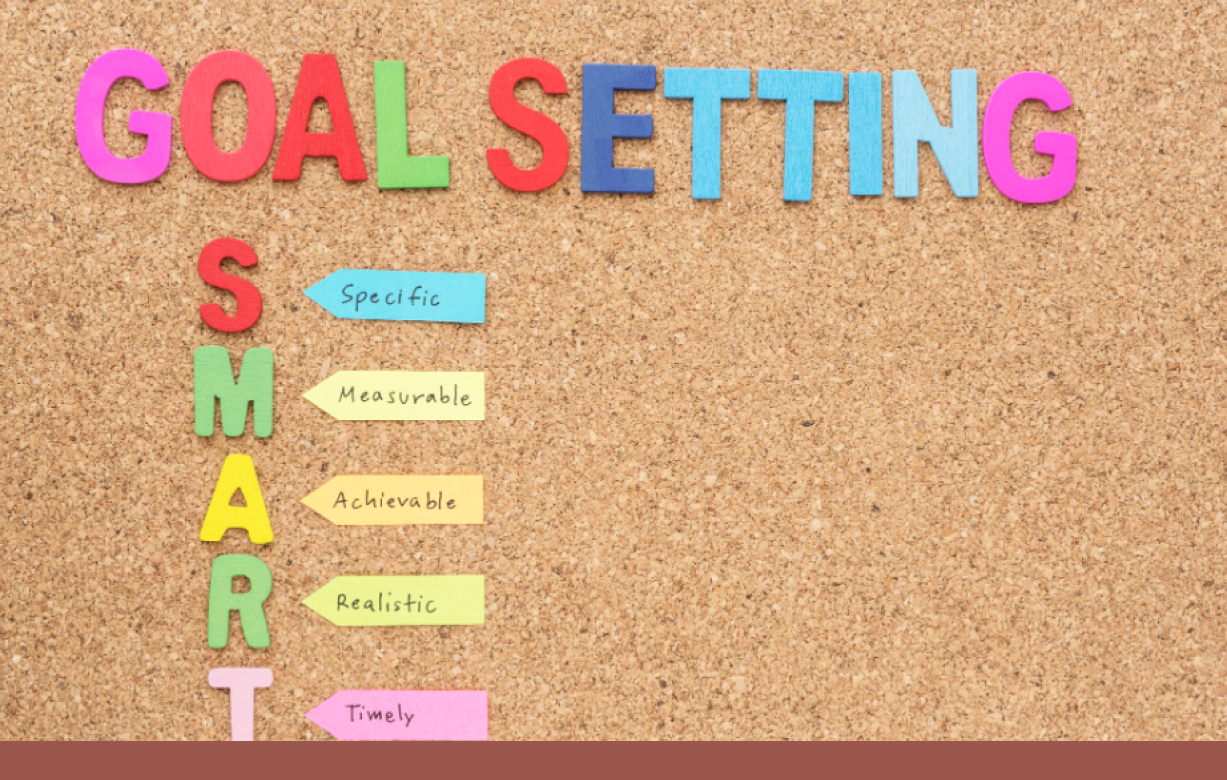

Setting SMART Financial Goals: Specific, Measurable, Achievable, Realistic, and Time-bound (SMART) goals are vital for financial planning. These goals provide a clear roadmap for revenue targets, profit margins, and other key financial metrics.

Realistic Goal Setting: It's important to balance ambition with realism. Goals should be challenging yet attainable, based on a thorough understanding of the business's expenses and revenue potential.

Truth and Transparency in Financial Planning: Accurate and honest assessment of the business’s financial situation is critical for setting realistic goals and making informed decisions.

Emotion-Free Decision Making: While passion is important in entrepreneurship, financial goal setting should be guided by logical and practical consideration of numbers and data.

Goals can encompass a wide range of areas in one's life, extending far beyond personal finances. These goals can be categorized into different aspects such as:

Work-Related Goals: They can include career advancement, learning new skills, improving job performance, achieving specific work targets, or even changing careers.

Personal Development Goals: They could involve acquiring new skills or knowledge, improving personal habits, developing new hobbies, or enhancing social skills. Personal development goals are tailored towards individual growth and self-fulfillment.

Educational Goals: They can range from completing a degree or certification to learning a new language or mastering a particular field of study.

Spiritual Goals: These might involve practices like meditation, religious study, or engaging in community service.

Lifestyle Goals: These are related to one's way of living and might include traveling, achieving a work-life balance, or living a more sustainable and environmentally friendly life.

Each of these goal categories plays a vital role

in shaping a well-rounded and fulfilling life

Timelines and Motivation: Attaching Dates to Goals

Attaching dates to each goal transforms them

from dreams to deadlines

A feasible yet motivating schedule is key. It's like setting up a series of checkpoints in a race. Each date should be realistic but challenging, pushing you to move forward. This approach keeps you accountable and maintains momentum throughout the year.

Crunching the Numbers: Financial Planning

Financial planning can't be overlooked. It's time to crunch the numbers. Budgeting for different aspects of your business, from marketing to product development, ensures you allocate resources efficiently. Understanding your financial status helps in making informed decisions and avoids overstretching your budget.

Preparing for Setbacks: Staying Agile

Setbacks are part of the business journey

The most common setbacks are:

Having an unscalable business model

Hiring the wrong people

Losing a major client

Reputational damage

Cash flow issues

Product recalls

Being prepared for potential challenges is essential. This could mean having a contingency fund or flexible strategies that can adapt to changing market conditions. Awareness of possible setbacks makes you resilient and ready to tackle obstacles head-on.

Daily Refresh: Keeping Objectives in Sight

Finally, refresh your objectives daily.

It's easy to lose sight of your goals amidst the daily hustle

Take a few minutes each day to revisit your planner. This daily ritual keeps your goals at the forefront of your mind and aligns your daily actions with your larger objectives.

Conclusion

In conclusion, a well-crafted business planner for 2024 is your blueprint for an exponential year of growth. By setting clear goals, attaching timelines, crunching numbers, preparing for setbacks, and refreshing your objectives daily, you're setting the stage for success. Remember, the journey to achieving great heights in your business starts with a single, well-planned step. Let 2024 be your year of remarkable achievements!

Disclaimer: This article is for informational purposes only and should not be considered as financial or investment advice. Please consult with a qualified financial advisor before making any investment decisions.

"In every brick and mortar, Bentley Richards sees more than just a structure; he envisions a future of intertwined dreams and endless possibilities, driven by the spirit of community. Hailing from the heart of Los Angeles, Bentley's journey in real estate began with footsteps tracing his grandfather's path through the city's apartment buildings.

It's a journey that has spanned from nurturing a single apartment edifice to managing a portfolio of 1,800 units across four states. He has also established Agoura Hills Financial, orchestrating debt placements exceeding $120 million. However, Bentley's most defining legacy is reshaping affordable housing with a blend of societal upliftment and impressive ROI. He has worked with organizations like the Veterans Administration Housing Program, charting a course of community-centered growth. With multifaceted experience as a property owner and lender, Bentley is currently leading the development of 252 socially conscious units in Los Angeles. Join him in redefining the affordable housing landscape while experiencing compelling financial returns. Let's shape a reimagined future for Los Angeles together."